Wayland Finance

...is to have an operational override every other year, and ask our taxpayers to keep digging deeper. Is that a fiscal strategy? Is anyone willing to look at alternatives?

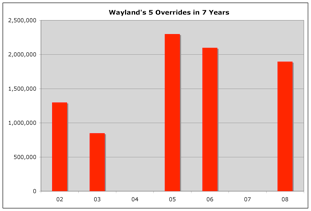

We have had 5 operational overrides in the past 7 years FY2003 to FY2009 (FY = Fiscal Year) totaling $8,446,000. Here is the chart (Source: DOR data bank)

That resulted in one of the highest tax rates of our peer towns, and an average tax increase of about 70%.

This is a history, since 2002 of our 5 overrides in 7 years.

(Note: FY2003 occurs in year 2002, FY2009 occurs in year 2008 and so on...)

Officially the Finance Committee (FinCom) stated that they wish to avoid annual overrides, but they are planning for an override every other year

On February 2, 2009, the FinCom stated that it anticipates that 2010 will be an override year. This means every even numbered year (the pattern began in 2006) we can expect an override. That is the year for taxpayers to dig a little deeper.

Is this the way to fund our operations? It was never the intent of Prop 2 1/2. More importantly, is this sustainable for you?

On the years between the overrides we borrow from the cash account (some call it the rainy day fund). Were doing it this year to the tune of $1.1M.

See Article on Longer Term Structural Problem in Wayland - Crier 2/27/09

The town does make attempts to reduce its costs in many ways but the single most effective way to do it is also the most painful: asking our employees to take pay freezes and/or pay cuts. We don’t do that. Instead we ask our taxpayers to dig deeper, and we ante up every other year, making it harder and harder for citizens to survive in Wayland.

Is it justified to ask for pay freezes or pay cuts? I say that it is and there is no better time than now. The vast majority of citizens are worried about their financial future and many have been laid off, have seen their 401(k) plans deflated, their housing equity deflated, are living in the shadow of unemployment or are facing pay cuts, freezes or layoffs themselves.

It makes absolute sense for our town government to do the hard work of asking for union concessions. The unions will not like it and they will resist - no doubt. The teachers union is well known to take a position of absorbing layoffs, preferring that the survivors will keep the raises. But Wayland hasn’t failed an override in 20 years, so Wayland has no negotiating leverage. Wayland taxpayers just keep digging deeper.

In Wayland we all love our schools and the town’s reputation as an historically fine school system. The schools represent 70% of our town’s spending. If the teachers and administrators would agree to take cuts or freezes then there would be no need for layoffs, and class sizes would be preserved. The taxpayers would get a break and we would all share the sacrifice.

The town-side unions should do the same. We all should share in the sacrifice.

I don’t think that this is an unreasonable position to take. This is why I call for a 3-year tax moratorium.

Ask the other candidates how they feel about this logic.

Thank you for taking the time to consider these ideas. I ask for your vote on April 7th.

The moody’s story

There are two ways to maintain Wayland’s Aaa rating:

Increase taxes via overrides to pay for more spending; or cut services to avoid higher taxes.

Our town government prefers to increase taxes.

Moody’s is one of a number of bond rating companies who issue financial ratings on the financial strength of a borrower. But we should remember, Moody’s rates from the viewpoint of the loaner or the investor. The investor wants to know how confident he can be of receiving back his loan and in the case of a town, this has a lot to do with the perceived ability for a town to levy taxes and collect taxes into the future.

The Moody’s report was covered in the Wayland Town Crier and the quote that was given:

“Selectmen Chairman Michael Tichnor said of the report, "This reflects the fact that we’re a well-managed town and we take pride in that ... We do have a strong financial position, and everyone works very hard on that," particularly noting the efforts of the Finance Committee.”

(Click here to read the Moody’s Report on Wayland)

The quote above by the Chair of the Board of Selectmen seems to assert that our Aaa rating is due to Wayland being a well managed town.

On page one of the Moody’s report it says:

“IMPROVED FINANCIAL POSITION EXPECTED TO FACE CYCLICAL PRESSURES OVER THE NEAR TERM; STRONG HISTORY OF VOTER-APPROVED OPERATING OVERRIDES”

Remember, Moody’s looks at this from the investor’s point of view. If you were an investor in a town; wouldn’t you want to know that the town has a strong history of passing operating overrides? What this means is that the town has shown a strong history of digging deeper and deeper to balance its books.

I spoke with Moody’s last March and they told me that the investor cares about 2 things:

-

1.If the services remain the same then the taxpayers must come up with the required funds to keep it going or,

-

2.If the taxpayers do not continue to come up with the funds to keep the services going then the town must makes the cuts. If it does then “its a wash”

Override + Services = Aaa

No Override + Cuts = Aaa

The investor doesn’t care about our services, he only cares about getting repaid with interest.

I contend that what Moody’s is saying is that Wayland follows the first rule:

Override + Services = Aaa

And contrary to what Mr. Tichnor said above, I believe that its more about the overrides than about anything else.

So one way to look at this is that the Aaa rating may reduce our interest debt when we borrow but it causes our tax burden to go up whether we borrow or not.

Wayland’s fiscal management strategy...